SEBI Introduces BRSR Core with Enhanced Reporting, Assurance & Value Chain Disclosures

In recent years, there has been growing interest in ESG (environmental, social, and governance) disclosures. Investors, regulators, and other stakeholders are increasingly demanding more information about the ESG performance of companies.

In response to these demands, in 2021, The Securities Exchange Board of India (SEBI) strengthened the ESG disclosure regime by rolling out a Business Responsibility and Sustainability Reporting (BRSR) framework, which requires the top 1,000 companies (by market capitalization) to disclose their ESG initiatives based on the nine principles of the National Guidelines on Responsible Business Conduct (NGRBCs). This report was required to be included as a part of the annual reports with effect from FY 2022-23.

The ESG regulatory landscape in India is evolving fast to create a level playing field for Indian companies in the global markets.

In July 2023, SEBI released an upgraded BRSR framework and BRSR Core to further strengthen the quality, transparency and reliability of ESG disclosure for listed companies. The new requirements cover the applicability of BRSR Core, disclosures for the value chain, and specifications on assurance, including an approach.

STRUCTURE

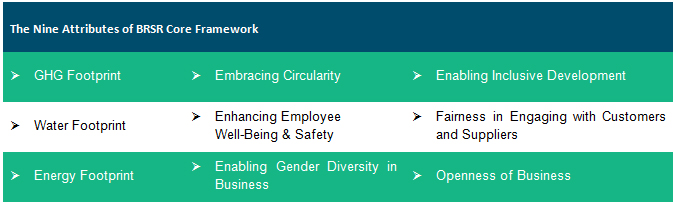

BRSR Core is a sub-set of the BRSR format. However, the BRSR Core carves out a set of 40+ Key Performance Indicators (KPIs) classified under nine attributes, which are highlighted below.

Refer to Annexure-1 of SEBI Circular No.: SEBI/HO/CFD/CFD-SEC-2/P/CIR/2023/122

Key changes include the introduction of new KPIs such as ratios based on the Purchasing Power Parity (PPP) for better global comparability, job creation in small towns etc. Further, some of the leadership indicators in the earlier BRSR are reclassified as essential indicators, thereby making them mandatory disclosures.

From FY 2023-24 onwards, the top 1,000 companies (by market capitalisation) listed on the stock exchange will have to provide disclosures on the updated BRSR format which includes the Core disclosures. This report is required to be made a part of the annual report.

ASSURANCE

The listed companies are required to obtain a reasonable level of assurance on their BRSR Core disclosures from an independent third party. This will ensure that the disclosures are accurate and reliable. SEBI has provided a glide path for companies to adopt to the assurance standards as per the timelines shown below.

Refer to Annexure-1 of SEBI Circular No.: SEBI/HO/CFD/CFD-SEC-2/P/CIR/2023/122

"The approach of reasonable assurance of BRSR Core (select disclosures) is different from EU ESG assurance approach, which initially focuses on limited assurance but on the entire set of disclosures."

SEBI has not specified any particular assurance standards for BRSR Core assurance. Due to the absence of an Indian sustainability assurance standard, companies have been adopting AA 1000 (by Accountability) or ISAE 3000 (by International Auditing and Assurance Standards Board) in combination with specific subject matter standards like ISAE 3410 for assuring greenhouse gas emissions

In January 2023, the Institute of Chartered Accountants of India (ICAI) issued an India-specific assurance standard Sustainability Assurance Engagements (SSAE) 3000 in addition to existing specific subject matter standards. These developments are expected to ease companies' challenges in navigating the assurance process.

VALUE CHAIN ESG DISCLOSURES & ASSURANCE

Further, the top 250 listed companies (by market capitalisation) will be required to disclose the ESG information of their value chain members on BRSR Core. For this purpose, the value chain consists of the company’s top upstream partners (suppliers) and downstream partners (customers), cumulatively comprising 75% of its purchases/sales (by value). The reporting can be separate for upstream and downstream partners or can be reported on an aggregate basis.

The BRSR Core disclosures for the value chain are applicable on a comply-or-explain basis from FY 2024-25. Further, the limited assurance of these disclosures is required to be performed on a comply-or-explain basis from FY 2025 - 26.

"Embedding value chain sustainability disclosures along with assurance could be an onerous compliance for mid-corporate entities in the short-term but will help them select the value chain partners that truly align with the company’s sustainability vision."

REQUIREMENTS FOR ASSURANCE PROVIDER

Competence and Independence are the two primary requirements set out by SEBI for ESG assurance providers. Furthermore, the board of the listed entity should ensure that the assurance provider for the BRSR Core possesses the necessary expertise for reasonable assurance. The board must also ensure that no conflicts of interest exist with the assurance provider and that its associates refrain from selling products or providing non-audit/non-assurance services to the listed entity or its group entities.

OUR VIEW

The framework is designed to improve the transparency and reliability of ESG disclosures and to encourage listed companies to adopt more sustainable business practices. This framework offers companies various benefits such as improved reputation, stakeholder engagement, risk management, access to capital, and competitive advantage.

However, the road ahead for implementation is not without significant challenges. First, the upgraded framework requires companies to re-image their processes across the value chain. Further, assurance requirements of the supply chain partners could significantly increase the compliance burden on companies. Several mid-corporates are still refining their sustainability processes across their procurement, production, sales and distribution.

SEBI’s approach of making BRSR Core a subset of the overall BRSR framework will help companies prioritize 40+ “Core” metrics from among hundreds of metrics while keeping the BRSR foundation intact. This will also help companies to bring their value chain partners under the ambit of National Guidelines for Responsible Business Conduct (NGRBC) in a structured and consistent way which is more difficult in the current reporting regime.

Further, BRSR Core has references to the BRSR for ease of reference. The listed companies can also continue to cross-reference the disclosures between BRSR and global frameworks such as GRI, SASB, IR, TCFD etc. The alignment of BRSR with International Sustainability Standards Board (ISSB) could further strengthen the BRSR and BRSR Core’s appeal to the global stakeholders. Finally, this “Core” approach “Assures” global regulators, intermediaries, investors, and other stakeholders on transparency of disclosures and comparability across companies and helps in promoting sustainable corporations.

Ravi Sankar Nori, COO-ESG at Singhi & Co.

For any feedback, please write to us at esg@singhico.com